Bitcoin has reached local highs below $69,000 after weeks of steady bullish price action, igniting excitement and caution across the market. Investors are bracing for potential volatility, as this critical price zone has triggered sharp rejections five times in the past few months.

While optimism is high for a surge beyond $70,000, uncertainty remains as traders watch for signs of a breakout or another pullback.

Key data from CryptoQuant reveals that liquidation levels on major exchanges are rising, signaling that a decisive move could be imminent. This increase in liquidations suggests that traders are positioning themselves for big swings in the coming week, either anticipating a continuation of Bitcoin’s uptrend or bracing for a rejection from this significant resistance level.

As Bitcoin approaches this crucial threshold, the next few days could determine whether it will break new ground or face another retrace. The entire market is on edge, waiting to see if Bitcoin will finally push past this resistance and enter uncharted territory.

Bitcoin Price Swings Intensify

The crypto market is at a pivotal moment, with Bitcoin and many altcoins pushing toward local highs, reversing the negative price action of recent months. Optimism is building among analysts and investors, who see Bitcoin’s rally as a sign of renewed strength across the market.

However, there are growing concerns that the path to new highs may not be a smooth upward climb. Instead, we may witness a series of ups and downs as the market navigates key resistance levels.

Key data from CryptoQuant, shared by Axel Adler on X, highlights the increasing potential for volatility. Adler’s analysis reveals a sharp rise in futures liquidations across major exchanges such as Binance, ByBit, and OKX.

If this trend continues, the market could experience heightened volatility as early as next week. His chart of total Bitcoin futures liquidations shows a pattern of rising liquidations, indicating that traders may be over-leveraging as they bet on Bitcoin’s price movements.

The upcoming week is shaping up to be one of the most crucial periods of this market cycle. As liquidation levels increase and the market approaches critical resistance zones, both bulls and bears are preparing for a major move. Investors are hopeful that Bitcoin will break through and trigger a market-wide rally, but caution remains high amid the looming potential for volatility.

BTC Price Action Details

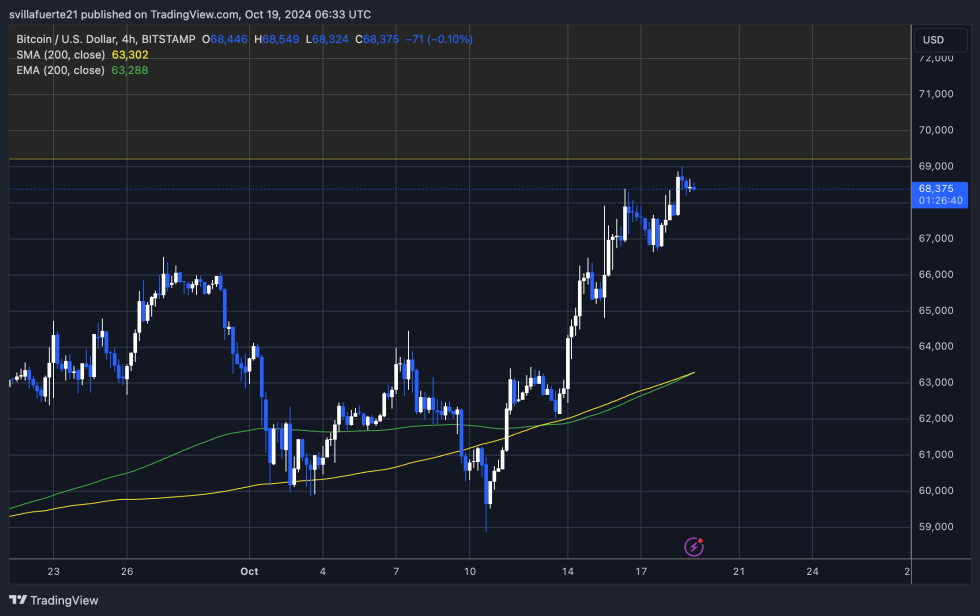

Bitcoin (BTC) is currently trading at $68,300 after recently setting a higher high on the 4-hour price chart. The cryptocurrency has been in a consistent uptrend since October 10, showcasing a clearly defined bullish structure that has excited investors.

However, there is a significant risk that the price may target lower liquidity levels to find the necessary fuel for a further push upward.

If BTC drops below the critical $66,600 mark, it could signal a deeper correction as the market seeks lower demand levels. Such a retracement would likely prompt caution among traders, as they reassess their positions in light of potential support levels.

Conversely, if Bitcoin successfully breaks above the psychologically important $70,000 threshold, it could trigger a wave of FOMO (fear of missing out) among investors. This surge in buying pressure could accelerate the price action, driving BTC toward new all-time highs.

The coming days are crucial as traders closely monitor BTC’s ability to hold its ground above key support levels or break through this significant resistance. The market sentiment remains cautiously optimistic, with participants eagerly watching for the next major move.

Featured image from Dall-E, chart from TradingView