As global markets navigate a landscape of fluctuating interest rates and mixed economic signals, the U.S. indices have shown resilience with notable performances in the small-cap and tech-heavy sectors, while European markets respond to easing monetary policies. Amid this backdrop, growth companies with high insider ownership can offer a compelling investment proposition due to their potential alignment of interests between company insiders and shareholders, as well as their capacity to capitalize on current market trends.

Top 10 Growth Companies With High Insider Ownership

|

Name |

Insider Ownership |

Earnings Growth |

|

Lavvi Empreendimentos Imobiliários (BOVESPA:LAVV3) |

11.9% |

21.1% |

|

Archean Chemical Industries (NSEI:ACI) |

22.9% |

34% |

|

Kirloskar Pneumatic (BSE:505283) |

30.3% |

30.1% |

|

People & Technology (KOSDAQ:A137400) |

16.4% |

35.6% |

|

Arctech Solar Holding (SHSE:688408) |

37.8% |

29.8% |

|

Seojin SystemLtd (KOSDAQ:A178320) |

30.7% |

49.1% |

|

Medley (TSE:4480) |

34% |

30.4% |

|

HANA Micron (KOSDAQ:A067310) |

18.3% |

105.8% |

|

Adveritas (ASX:AV1) |

21.2% |

144.2% |

|

Plenti Group (ASX:PLT) |

12.8% |

106.4% |

Click here to see the full list of 1485 stocks from our Fast Growing Companies With High Insider Ownership screener.

Underneath we present a selection of stocks filtered out by our screen.

Simply Wall St Growth Rating: ★★★★★☆

Overview: Goodwill E-Health Info Co., Ltd. focuses on the research and development of medical information software in China with a market cap of CN¥3.58 billion.

Operations: Revenue Segments (in millions of CN¥):

Insider Ownership: 20.4%

Earnings Growth Forecast: 51.7% p.a.

Goodwill E-Health Info demonstrates strong growth potential with forecasted revenue and earnings growth significantly outpacing the market at 24.6% and 51.7% annually, respectively, despite a recent net loss of CNY 27.47 million for the half year ended June 2024. The company’s price-to-earnings ratio of 93.6x is below the industry average, suggesting relative value in its sector. However, high share price volatility and no recent insider trading activity are notable considerations for investors.

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Goldcard Smart Group Co., Ltd. is a utility digitalization solution provider specializing in smart gas, smart water, and hydrogen metering in China, with a market cap of CN¥6.11 billion.

Operations: The company generates revenue through its operations in smart gas, smart water, and hydrogen metering within China.

Insider Ownership: 19.6%

Earnings Growth Forecast: 23.5% p.a.

Goldcard Smart Group shows promising growth potential, with forecasted revenue growth of 21.1% annually, outpacing the CN market. Despite a low return on equity forecast and dividends not being well-covered by free cash flows, its price-to-earnings ratio of 14.6x suggests good value compared to peers. Recent inclusion in the S&P Global BMI Index and steady earnings increase underscore its position in the market, although insider trading activity remains unreported recently.

Simply Wall St Growth Rating: ★★★★☆☆

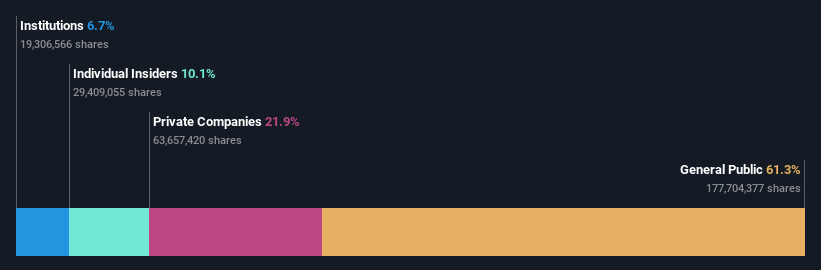

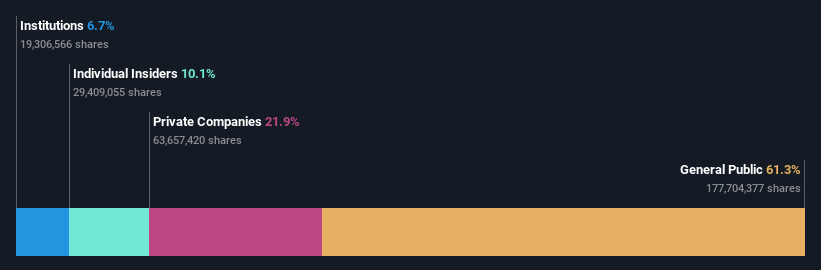

Overview: GuoChuang Software Co., Ltd. operates as a software company in China and internationally, with a market cap of CN¥5.64 billion.

Operations: GuoChuang Software Co., Ltd. generates revenue through its software operations both domestically in China and on an international scale.

Insider Ownership: 10.1%

Earnings Growth Forecast: 98.2% p.a.

GuoChuang Software Ltd. is positioned for significant growth with expected annual profit increases exceeding market averages, despite recent financial setbacks including a net loss of CNY 19.69 million for the first half of 2024. Revenue is forecast to grow at 18.6% annually, surpassing the broader CN market’s pace. However, share price volatility and past shareholder dilution present concerns. The company recently completed a share buyback worth CNY 20.47 million, indicating confidence in its future prospects.

Taking Advantage

Contemplating Other Strategies?

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

Companies discussed in this article include SHSE:688246 SZSE:300349 and SZSE:300520.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com